In the Road Runner cartoons of my misspent youth, Wile E. Coyote would chase the bird, often right over the side of a cliff. Both would keep running, but at some point, the hapless coyote would look down and realize he was in thin air. Only then did he plummet to the bottom of the canyon.

It’s August 2020. COVID deaths seem to have settled to a steady rate (that is, no longer accelerating, but still a terrifying daily plane crash full of premature deaths).

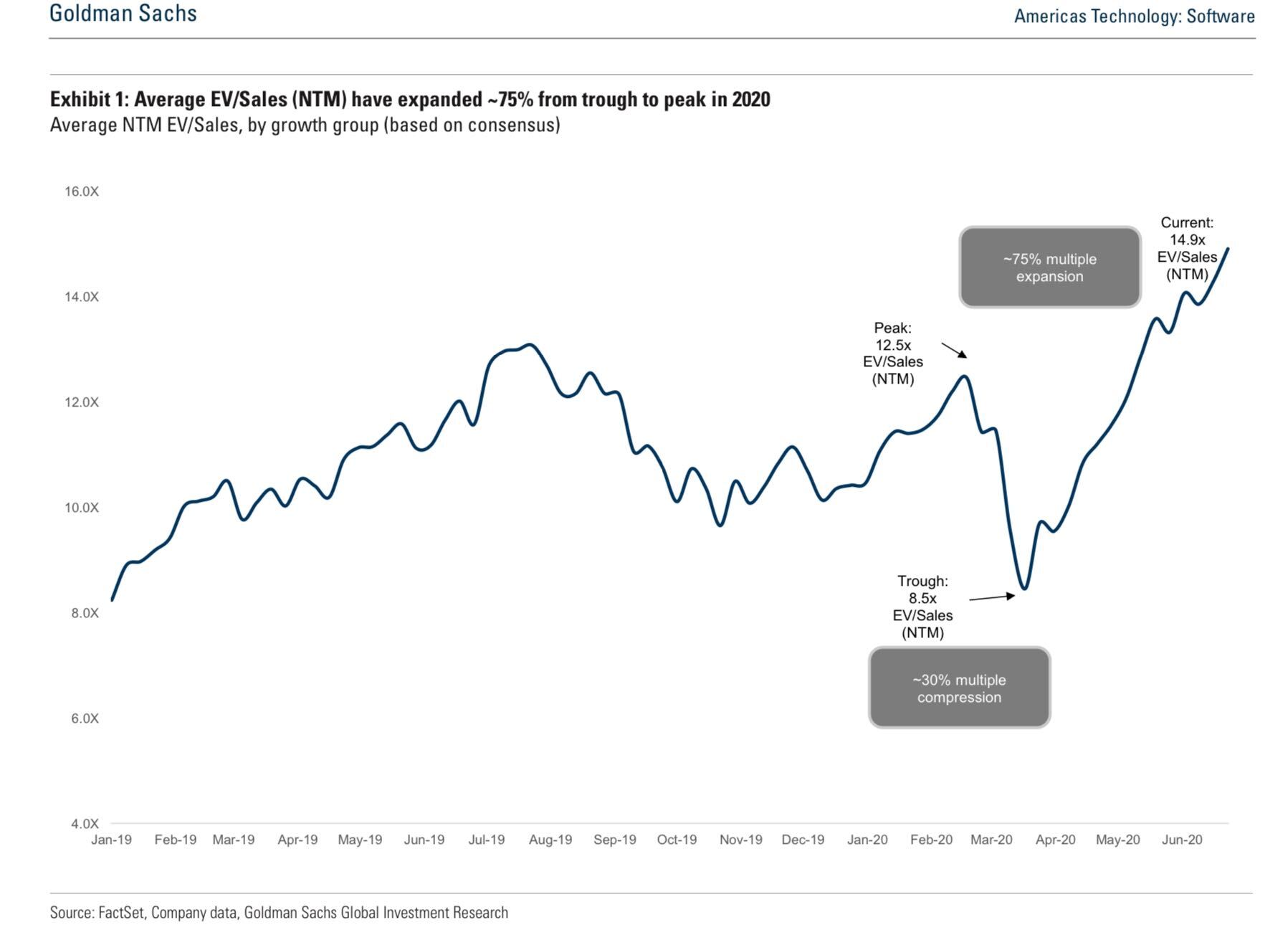

The stock market is at or near an all-time high. Software revenue multiples are high as ever. VC deal volumes (with a bit of reporting lag) are surging.

It’s not just financial assets. Top-tier market housing prices are strong as ever.

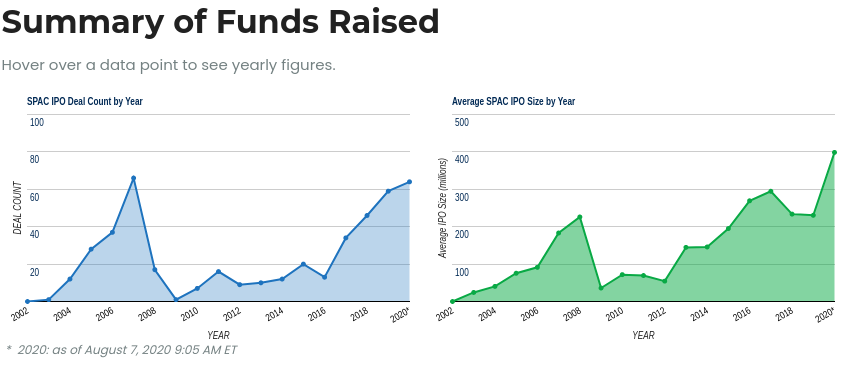

In addition, that venerable barometer of bubbliciousness, the SPAC, is pinging off the charts. Special Purpose Acquisition Companies, the so-called back-door IPO, have gone insane, nearly doubling the deal count and with a markedly increased deal size from 2019 to 2020, despite the pandemic.

My thesis is that the US economy is running on a form of inertia right now — the way Wile E. Coyote would run right past the edge of the cliff — and that an inevitable reckoning is due any moment.

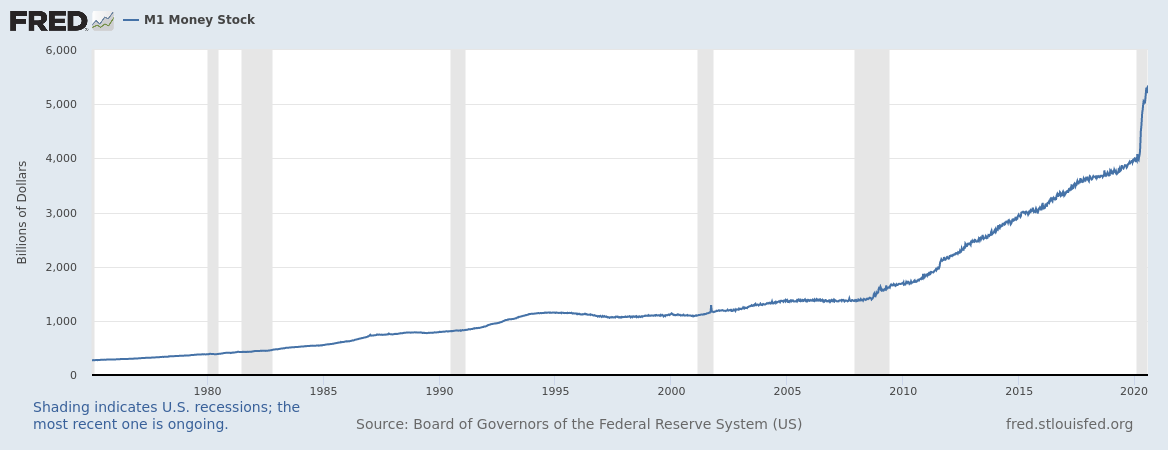

Why haven’t we seen this yet in asset prices (everything from stock tickers to VC deal valuations to house prices and bonds)? Absurd money printing. Money printing of a type and degree that dwarfs the 2008-09 crisis intervention.

In addition, this money printing is so furious it’s overflowing the usual spillways and is seeping or gushing out through all sorts of unconventional pathways (unconventional and, importantly, highly corruptible).

The Fed is literally buying corporate bonds, meaning, lending money to selected corporations. The stated reason here is to support the overall lending market, but the way that happens is literally by making it cheaper for companies to borrow than the market would otherwise price it at. That is, they are directly subsidizing the borrowing of select companies. They are a hair’s breadth from just buying individual stocks to support the price.

Arguably, the Kodak loan fiasco is exactly this, a debt-fired pump and dump directly orchestrated by a presidential crony.

Since that which is unsustainable cannot be sustained, I have a few predictions. They are absolute in effect but uncertain in time, though we have some hints about timing.

First, the current (Trump 1st term) administration will be doing absolutely everything in its power to goose the markets and the money supply through the November election. If 2020 starts to look like 2008, namely, the market tanks going into November, the incumbent will lose in a landslide. The incumbent’s only hope economically is to pump another speedball of easy debt and loose spending in. The administration, however, is so remarkably incompetent that we cannot be assured that they will succeed even in this.

Second, a major reckoning will come in equities, but it will probably be an across-the-board, “risk-off” correction where all assets deflate in price. This will either be sort-of-orderly, in the sense that it may be a reaction to “strong medicine” from the Fed (unlikely until after the election and only in reaction to inflation that might arise from, say, an unexpectedly fast and effective vaccine release). Or, it will be not-at-all orderly, more in the vein of Q4 2008.

Third, public debt will go bananas. Tax revenues will be so screwed for so many jurisdictions that they will need to borrow record amounts. Unemployment coffers are empty, rainy-day funds are being emptied out, and personal and corporate income (and gross / B&O taxes like we have in Washington) will be so impacted that few states or cities are going to balance their budgets.

Fourth, longer term, the inflationary imperative WILL eventually take hold. I admit I expected that vast increase in money supply following 2008-09 would have had this effect, but it didn’t. But that was more of a steady asset price tailwind that went along with reasonably OK public finances and tax receipts. This time, the combined pressures of state and federal debt service levels will create an irresistible impulse for politicians to inflate away the debt.

(A note and a hedge: the risk-off reckoning and the inflationary imperative seem destined each to happen but obviously Washington DC and NYC will be doing their best to overlap them. If they stick that landing, virtuosic if improbable, then we might not see them independently happen. Rather, you might get CPI inflation kicking in for the first time in a while while financial assets stay bounded. But I think it likely that you see them independent: first a financial asset correction and then a scramble to prop it all up which results in the inflation.)

Fifth, the generational effects here are going to drive massive political will to swing the pendulum away from favoring accumulated capital. Since the effects of asset price inflation (even the relatively mild continuous stuff we’ve been seeing) tend to hugely advantage large and leveraged asset owners, those who are currently under age 31 (average first time home buyer) are going to get the double whammy of increased dependency ratio along with basically no benefit from asset inflation. This will be Piketty r<g stuff. They are going to vote the bastards out.

So. It’s going to be a bumpy decade. Hold on to your hats. And hold some cash, TIPS, and gold. (Do NOT buy more beans and ammo than you should already have; there IS no run-for-the-hills scenario because we need each other to feed, heal, supply, counsel, teach, and otherwise keep body and soul together. There is no America if you are shooting neighbors over your canned beans.)

Very soon, and it may be while the heat of summer still rages, Wile E will look down and discover the canyon below. One thing is certain for me though: gravity exists and it will not let the coyote cross the canyon to the other side completely without some kind of reckoning.

In Part II I will have some more specific thoughts about how the Wile E Coyote inertia is affecting specific social relations in the world of entrepreneurial startups.